Technology

The Optimal Office

Problem:

There are many areas Advisors are asked to learn about technology: data integration, compliance compatibility, system hardware requirements, user learning curve, price points and contract requirements, client interface, reporting, portability, etc.

Solution:

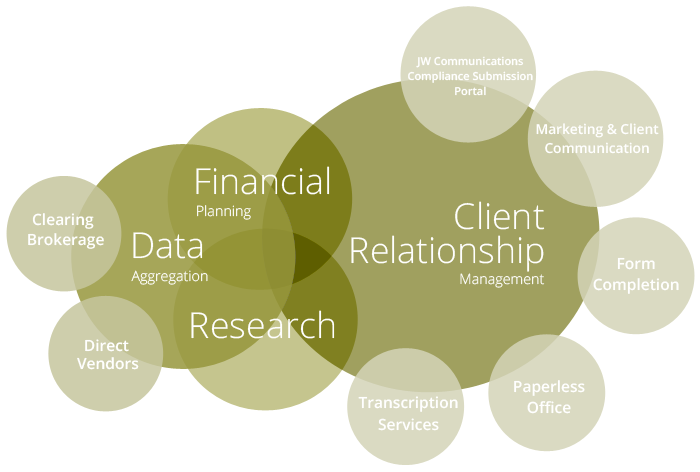

This plan shows an ideal office of the future, centered around a great client relationship tool, with trading, client reporting, planning and marketing all integrated. We have also included research and analysis tools, application pre-population capability, meeting note automation and a paperless office structure. Of course, this is not "Optimal" for everyone, but we are prepared to help customize a solution for your practice.

To help our Advisors make better decisions, JW Cole has invested in a Department of Technology Solutions. Because each Advisor has their own unique business model, product preferences and client interaction plans, our Technology Solutions Department is prepared to customize a solution for every Advisor which we call The Optimal Office™.

Technology Partners

Client Relationship Management (CRM)

A CRM is a key component to running a successful practice. A high-quality CRM may be used for a variety of reasons such as contact data storage, workflow processing, note storage, data repository for integrated tools, and can be used as a way to analyze your entire book of business. The future success of your practice will rely largely on your commitment to using your CRM to its fullest potential.

Financial Planning Software

There are many different schools of thought regarding what the best methods are for developing a financial plan. The best answer to this question is simply that each situation is unique and may require a different method for developing a sound financial plan. A high quality financial planning tool will offer a variety of methods for calculation, simulations, and reporting features. Many of these tools also integrate with CRM tools to allow automated storage of prepared plans for regulatory compliance purposes.

Form Filling Solutions

Paperwork is often a primary concern for every practice at some point. The importance of completing paperwork accurately, completely, and maintaining up-to-date forms can be challenging at times. A form completion tool that integrates with your LaserApp® Software makes it simple to use your existing client data to automatically populate the broker-dealer, clearing firm, and direct product sponsor forms you use most. This technology enables you to complete a typical broker-dealer new account form in about one minute. You can quickly edit the forms right from your computer screen! Since many accounts require numerous forms to be completed, you can save hours the very first time you use Laser App.

IT Solutions

Avision Technologies works hard to make sure you have the tools you need, when you need them. Whether you are looking for custom software, cloud-based productivity tools, network security and support, or any other IT-related project, their team is ready.

Transcription & Dictation Services

Notes are a key component to maintaining compliance with several regulations as well as maintaining a sound understanding of your clients’ needs. Transcription services allow you to simply speak exactly what you would like your notes to say and then have them delivered to your CRM or your email where they can be properly filed by you or a member of your team.

Practice Management & Marketing Solutions

In the financial services industry, a Financial Advisor’s “product” is the ability to connect with clients and prospects. Often times, this is accomplished one client and/or prospect at a time as they engage face-to-face with an Advisor, but it is just as important to share the same messages through other outlets. Whether that be through a website, marketing materials, office presentation, or on social media, it is important to send a consistent message and have a harmonious feel. In today’s environment, marketing plays a large role in first impressions and in establishing new (and maintaining existing) relationships.

Wealth Reporting & Account Aggegation

We all know that there are thousands of choices for the investments that your clients can hold. Keeping track of how each investment with each service provider is performing is a daunting task. A high-quality data aggregation system will collect your clients’ data from a variety of sources allowing you to see a true portfolio picture of your clients’ holdings. Many data aggregation services also allow for this data to be automatically transferred to other tools and allow client level access, benchmarking tools, and automated reporting.